Introduction

For crypto investors seeking the right tools to manage and monitor their digital assets, DeBank and Nimbus are two prominent platforms offering a range of features. In this article, we'll conduct an extensive comparison of DeBank and Nimbus, delving into their key features, advantages, and distinctions.

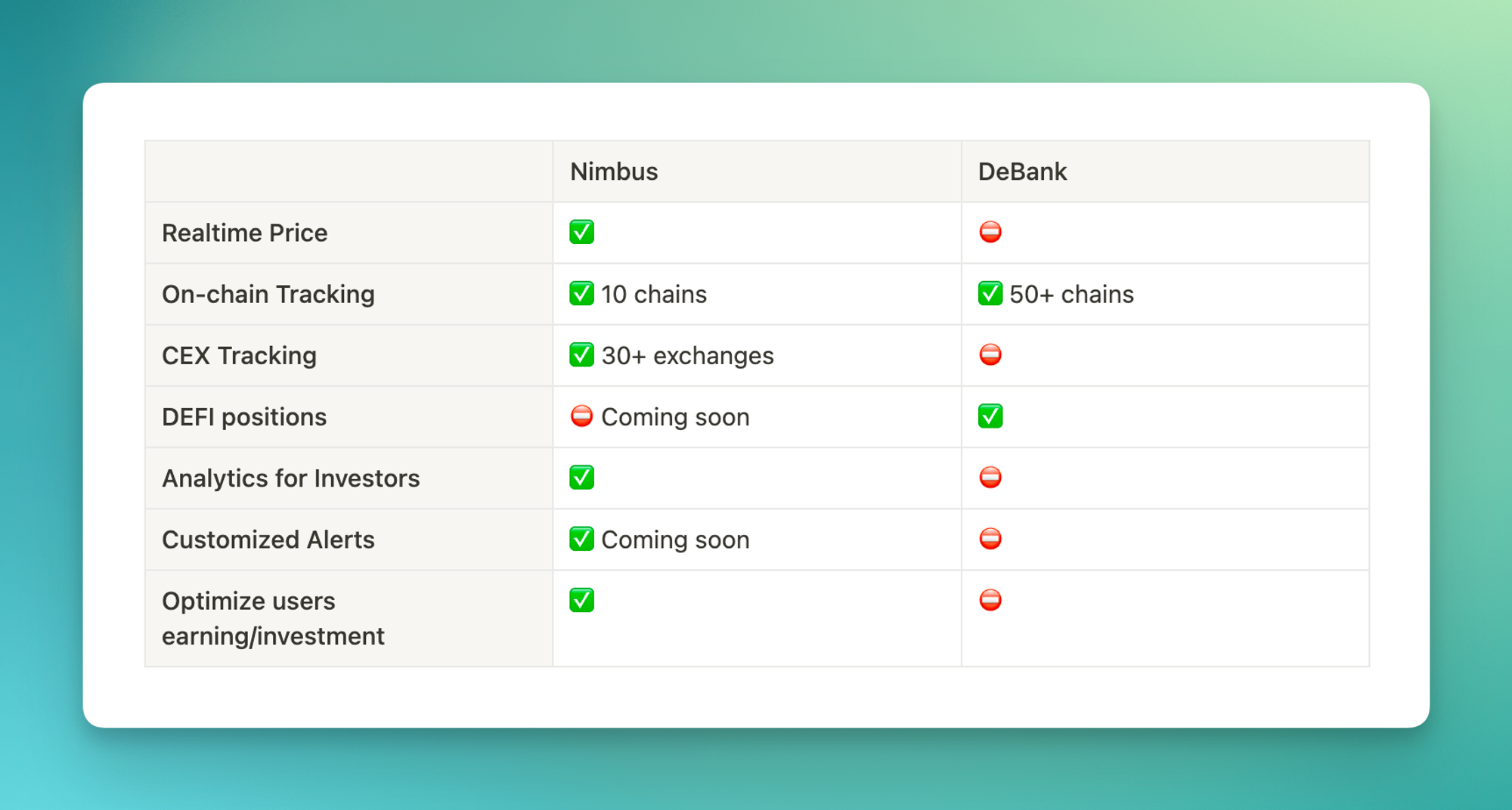

TL;DR

Real-Time Portfolio Tracking

DeBank:

DeBank provides a user-friendly interface for tracking your cryptocurrency assets. It supports multiple blockchains, making it a versatile tool for crypto investors to monitor their holdings across various platforms.

However, the price on DeBank always lags for 1-2 minutes compared to the market. That does not make too much impact on blue-chip token but for the meme coins, that price changes rapidly and lead to a big impact on investor’s decision.

Nimbus:

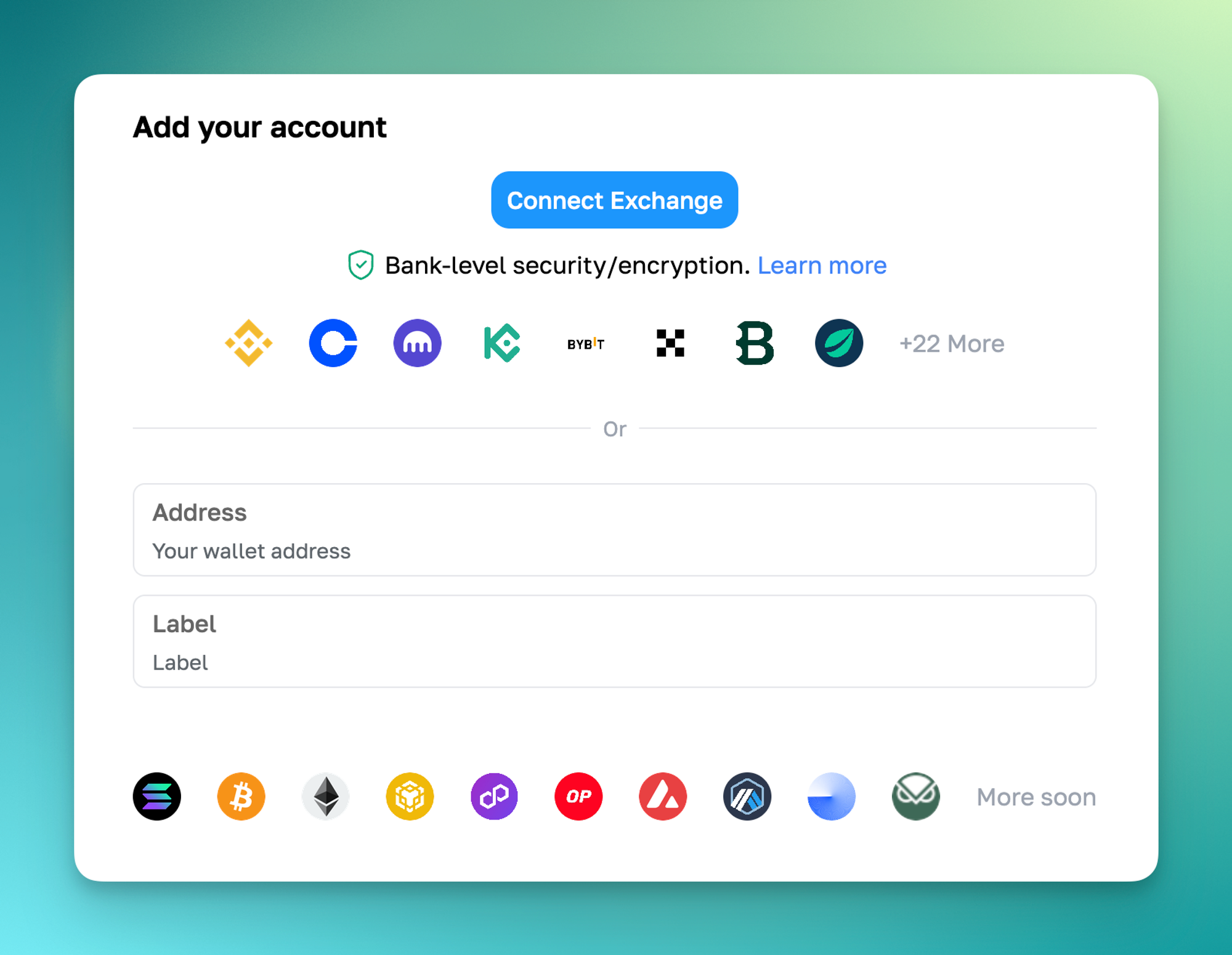

Nimbus, akin to DeBank, offers real-time portfolio tracking, but its standout feature is its commitment to delivering more comprehensive metrics tailored for investors. It accommodates a wide range of on-chain and centralized exchanges, including notable names like Binance, Coinbase, OKX, and ByBit.

Nimbus can also provide small token prices with its smart filter that can give MEME coin traders insight into real-time

Tracking multiple platforms

DeBank:

DeBank doesn't support tracking any CEX, so if you have your token in CEX, DeBank can’t help.

For the on-chain data, DeBank is the leader on this part with top. So DeBank can give a smooth experience for degen that usually navigates on lots of chains.

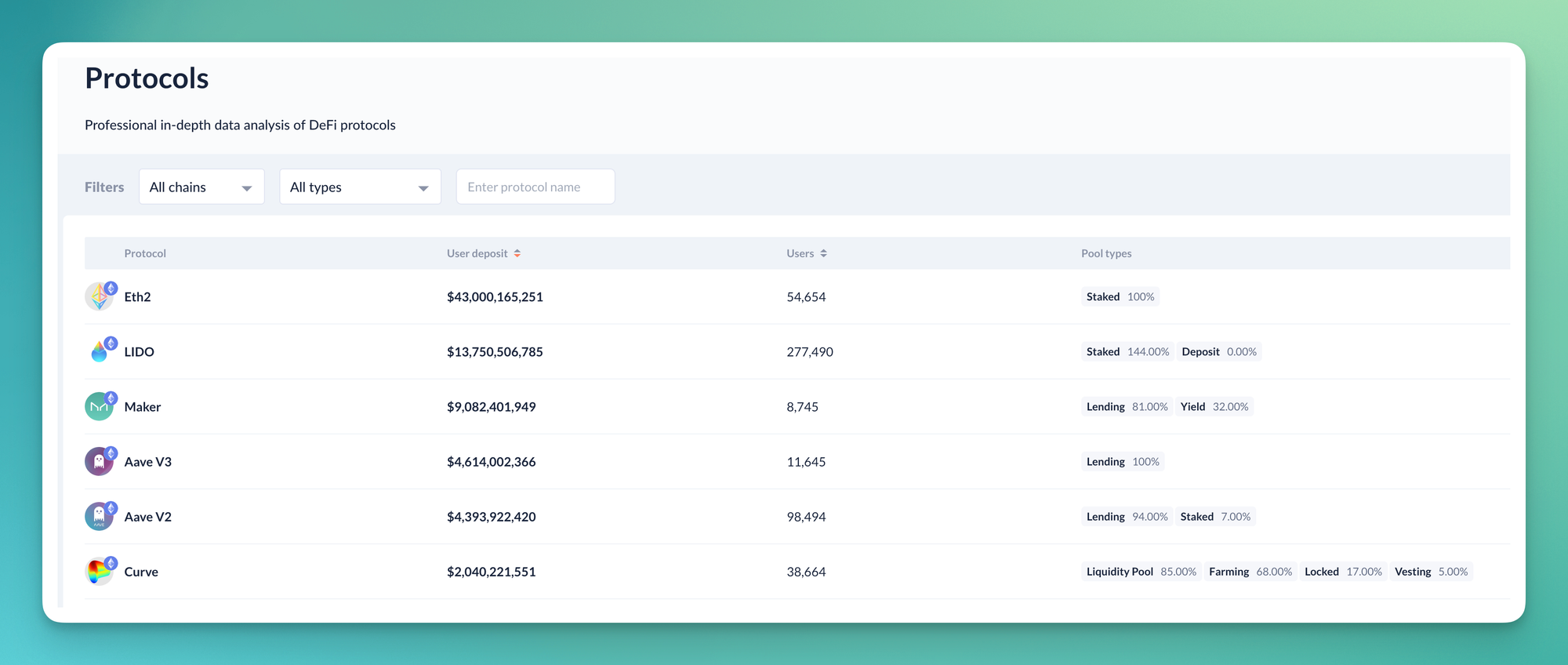

A killer feature of DeBank is that they support huge DEFI positions with no other tool can reach that level, giving users a clear overview of where their token is and how it works

Nimbus:

With the vision to help users track their investment in multiple places on only CEX or DEX. That makes a huge difference from Nimbus to DeBank. On Nimbus, you can track your investment in more than 30 exchanges including big guys like Binance, Coinbase, Bybit, Gate.io,…

For the on-chain data, Nimbus only supports Solana, Ethereum, Polygon, Arbitrum, Optimism, Base, BNB chain, Avalanche, and Bitcoin. Those chains have covered 95% of TVL so it can help most users track their investment on chain

Nimbus can not track DEFI positions for now but it is on their roadmap, so it looks very promises

Comprehensive Analytics

DeBank:

DeBank does not provide much analytics for users, as their vision is to build a social fi in which everyone can post content, and get alpha signal, they tend to lack focus on building some needed metrics for users.

Nimbus:

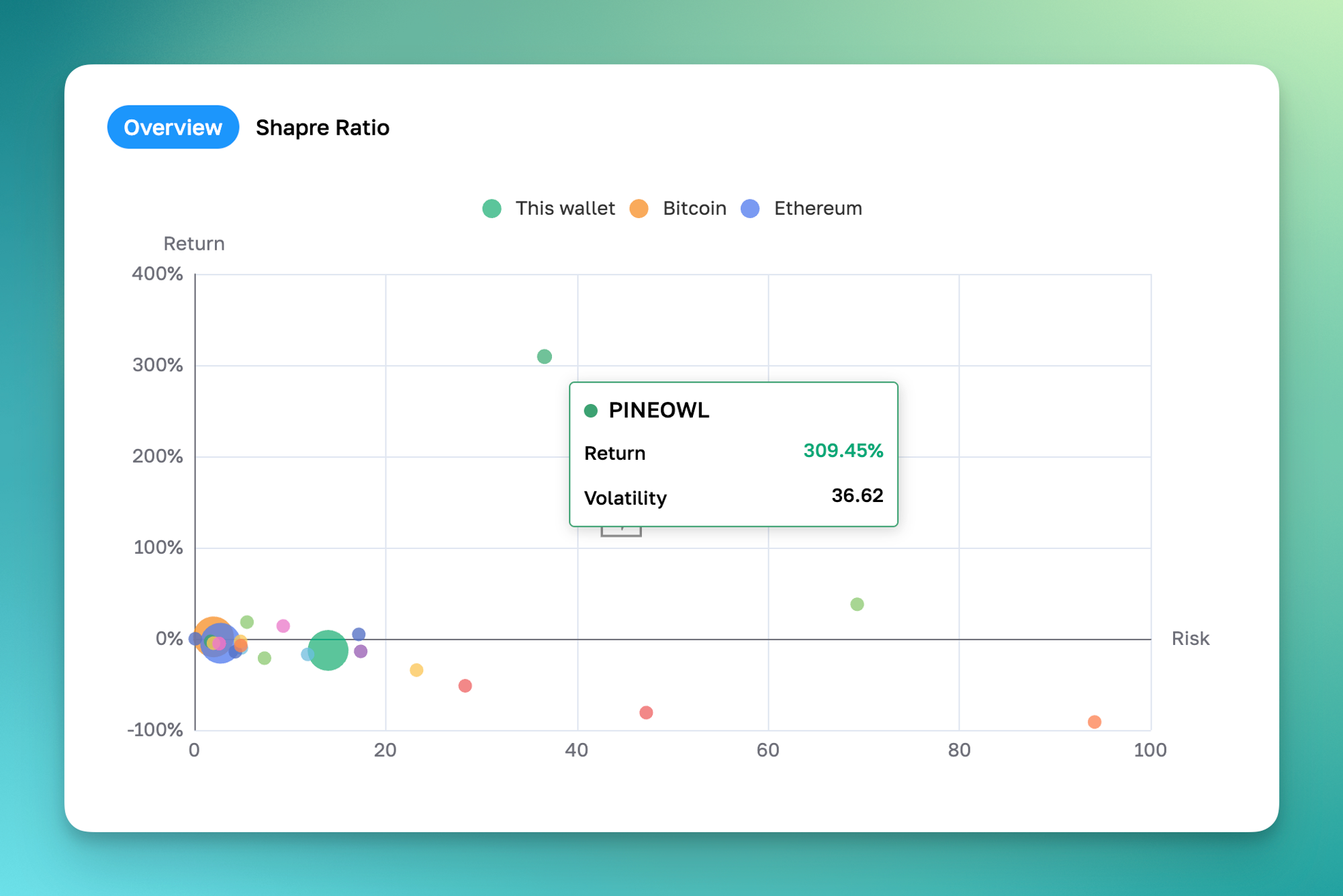

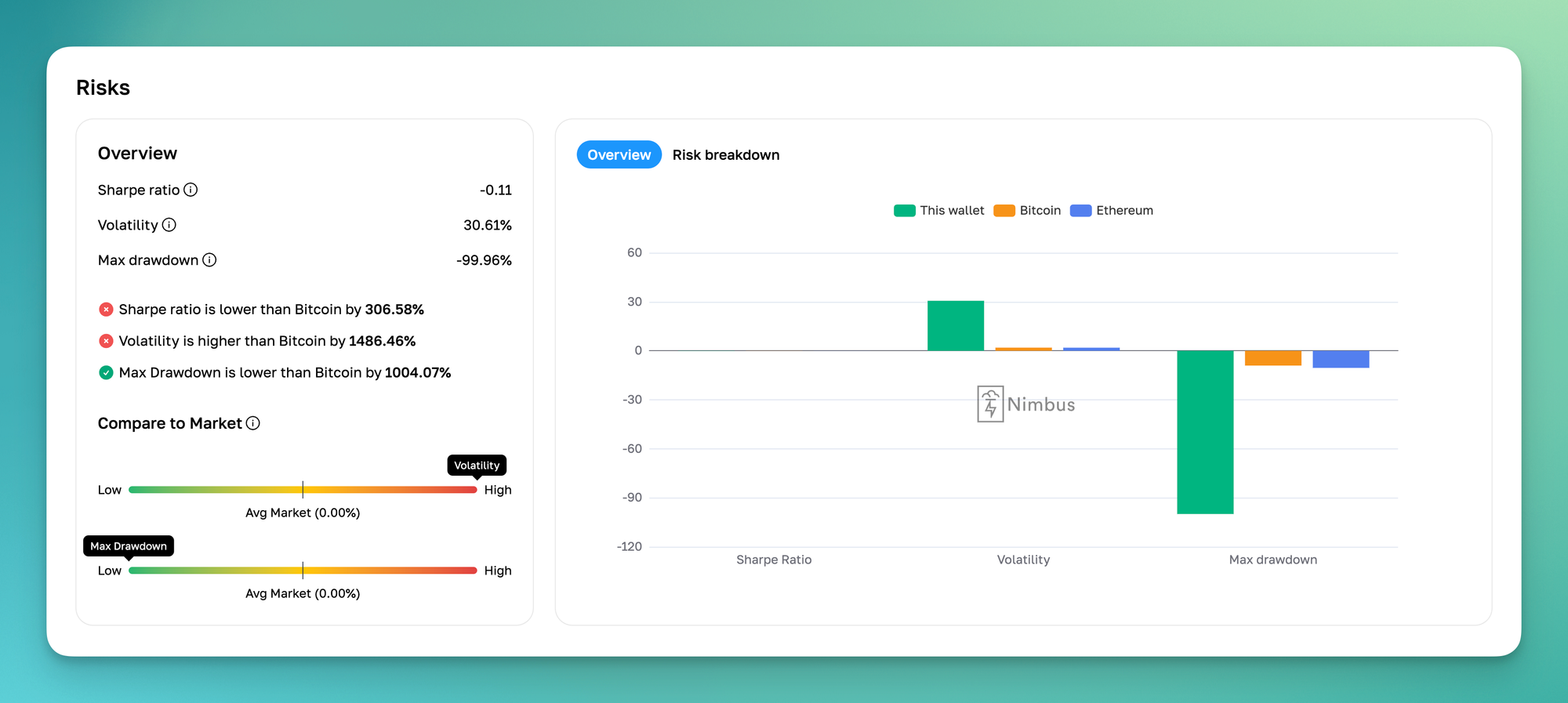

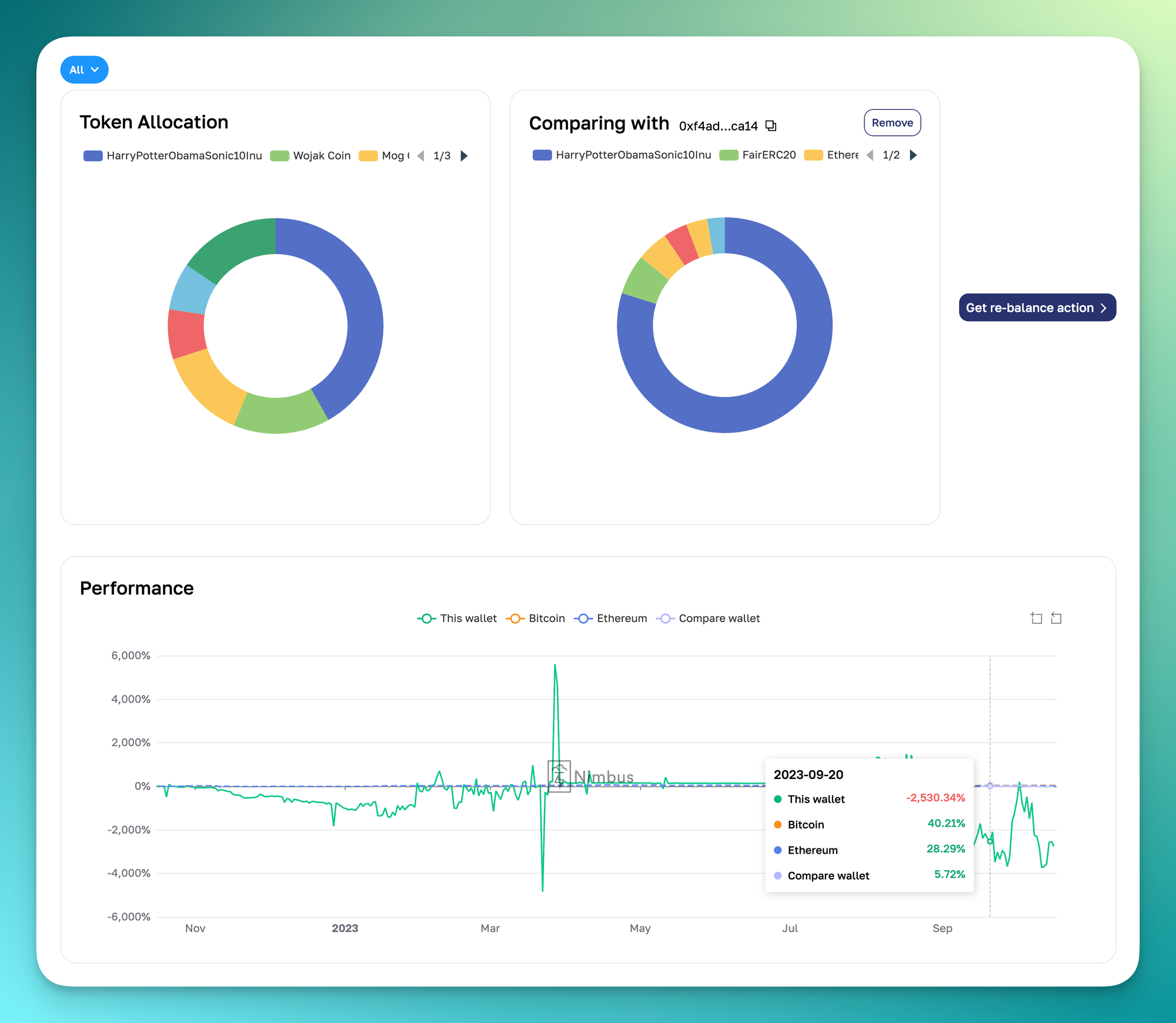

Nimbus takes analytics to a higher echelon, offering in-depth insights into portfolio profitability and risk management. With metrics such as profit and loss (PnL) analysis, risk assessment, and allocation insights, Nimbus is a superior choice for those craving more detailed and customized data.

With the product focus on investors, metrics built on Nimbus bring 360 views of users’ investment, making them understand what is going on with their investment from the overview of every single token

Customized Alerts

DeBank:

Actually, DeBank doesn’t support any alerts now, so if you want to keep notice of your portfolio you need to use other tools for that

Nimbus:

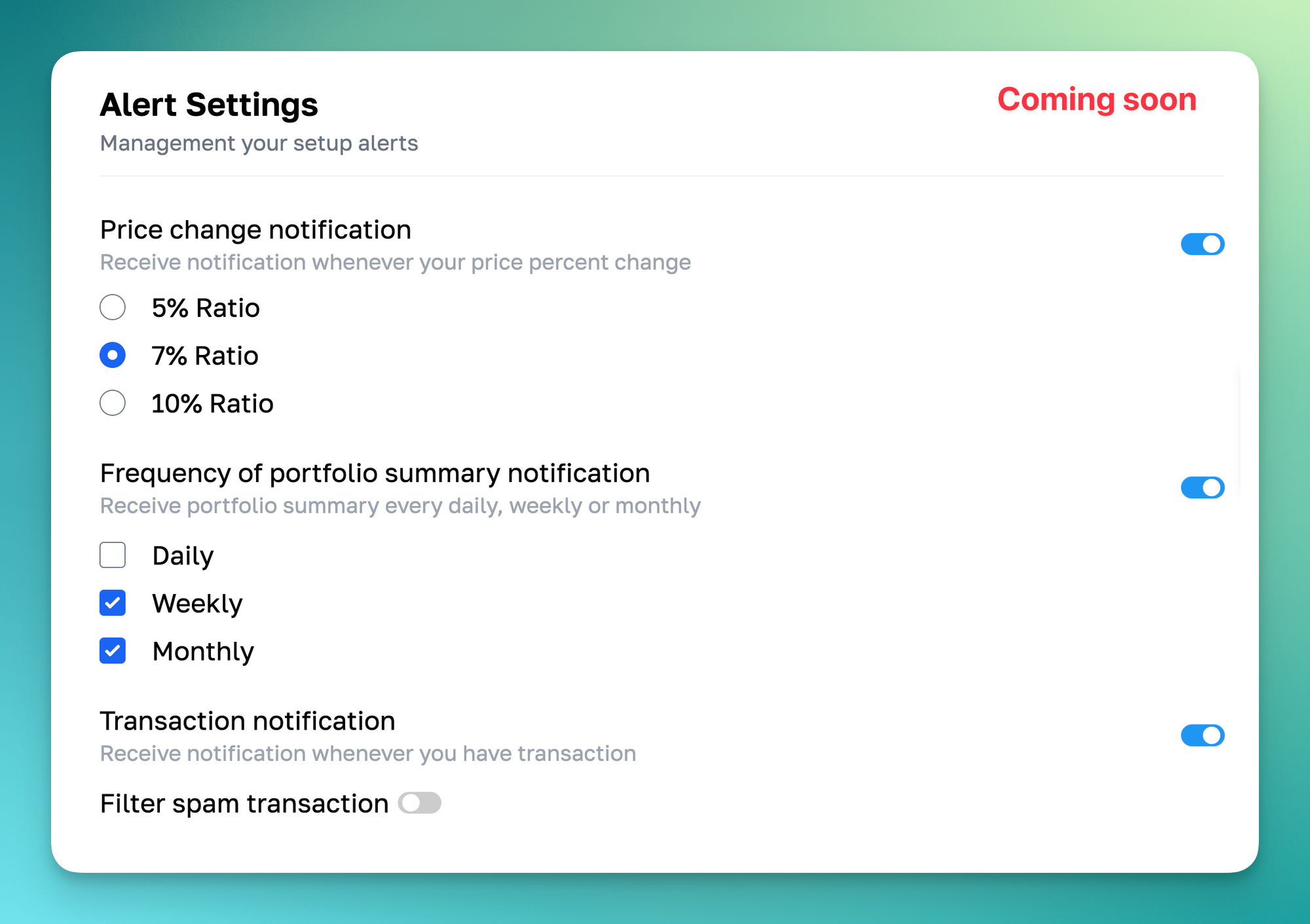

The feature is under development, but it comes with lots of promising things you can do with your portfolio.

Nimbus elevates the concept of customized alerts, permitting users to configure alerts for specific conditions, such as price fluctuations, changes in asset allocation, or notable market events. These personalized alerts serve as an invaluable asset for crypto investors.

Optimize users earning/investment

DeBank:

DeBank lets this part be for the user’s choice. So if you want to have some yield earning or your investment, you need to do it yourself with other tools

Nimbus:

On Nimbus, if you holding ETH, we suggest you put your ETH onto to Staking platform like Lido, or lend your ETH on AAVE, so you can keep holding your ETH and gain more by yield farming.

That’s not just only thing Nimbus can help with, for the token you’re holding, Nimbus can give you suggestions to allocate your holding by getting the Whale list that has the same tastes as you but with better performance. So you can hold your token on your favorite, but with better allocation to balance between risk and return

Conclusion

Debank and Nimbus stand as valuable tools for crypto investors, but they are geared toward distinct needs and preferences. DeBank excels at providing a huge amount of data on different networks, while Nimbus distinguishes itself with its comprehensive analytics, tailored alerts, and multiple platform support including on-chain and exchanges

So if you are an airdrop hunter, DeBank is the best suited for you. On the other side, if you are a true investor, Nimbus can bring you so much power to make more effective investment decisions and in return, gain more.

Remember that staying informed and proactively managing your crypto investments remains essential in this dynamic and ever-evolving domain.