How did we start?

Me and my co-founder - Toan are working at top corporations at the moment we decided to start Nimbus. Both of us had the dream job when we studied together at University but life seemed boring.

When I worked at CoinMarketCap, I saw lots of people needed to track their investments, they wondered how they were performing, and what is their profit but none of the tools in the market could clearly help them. Besides that, the manual input is boring and takes time to keep it in sync.

At the Luna crash event last year, I lost lots of money, but I didn’t know anything until I got back to my home after travel. So we decided to start Nimbus, a portfolio that is customized for your investment thesis, and help other people like me to be aware of the market.

So what is the problem?

Actually, I have lost lots of money in this market despise I have lived in this space since 2017. There are many lessons I have learned since then, some of them are small mistakes that I can ignore or move on from, but the others are as big as I become disappointed and leave this market for a few months.

Blockchain, crypto, DEFI, and MEME coin,… is an exciting things not just for me but for most people around me, they listen to those hyped terms, buy some tokens, and wake up with a huge profit that none of the investment channels can give them, and then they buy more tokens, the profit keeps growing, and then one day, all those token surges for 50% to 99%

After observing the market, and people around me for several years, I see some very serious problems in this market

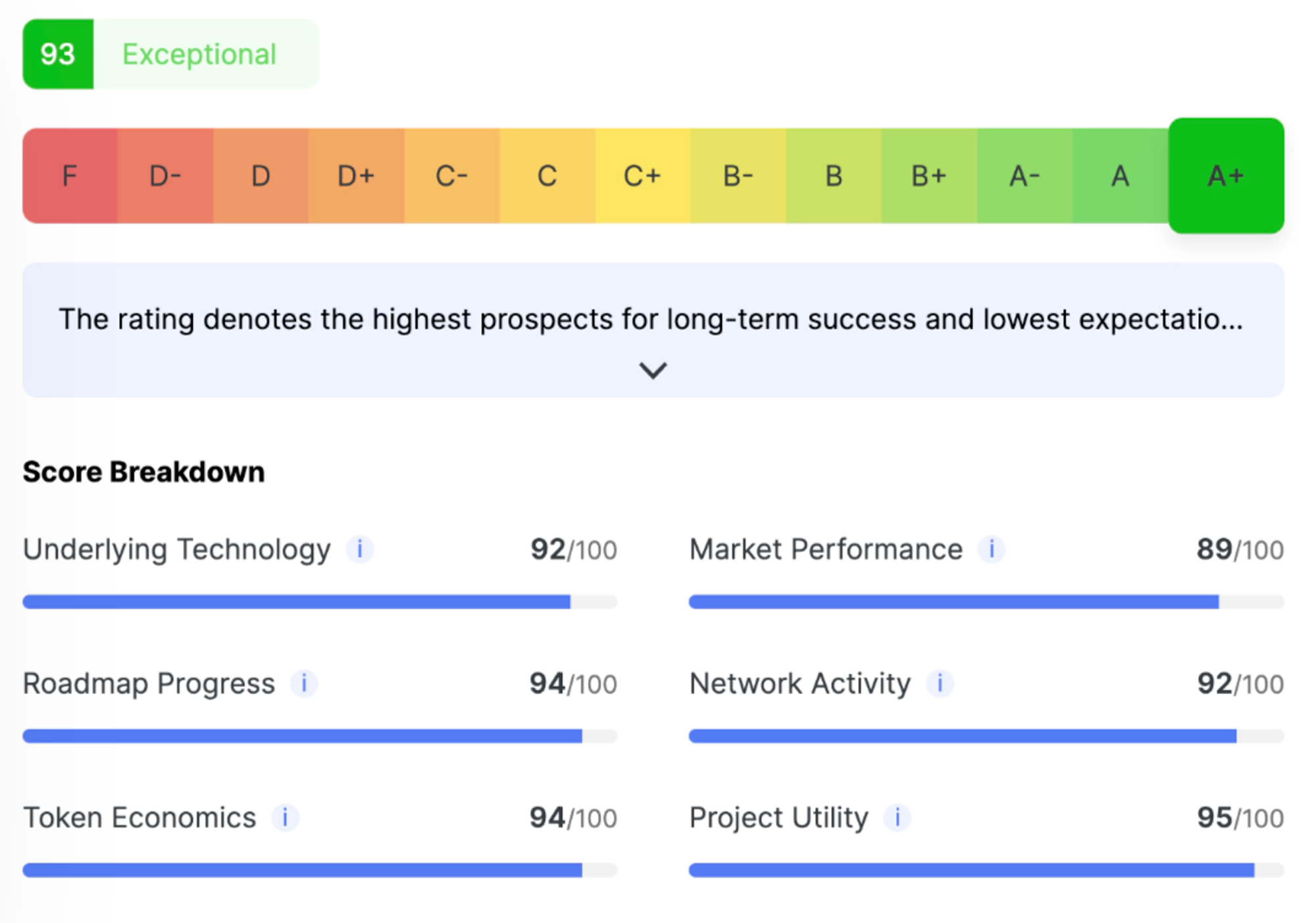

Lack of insightful information for their investment decision

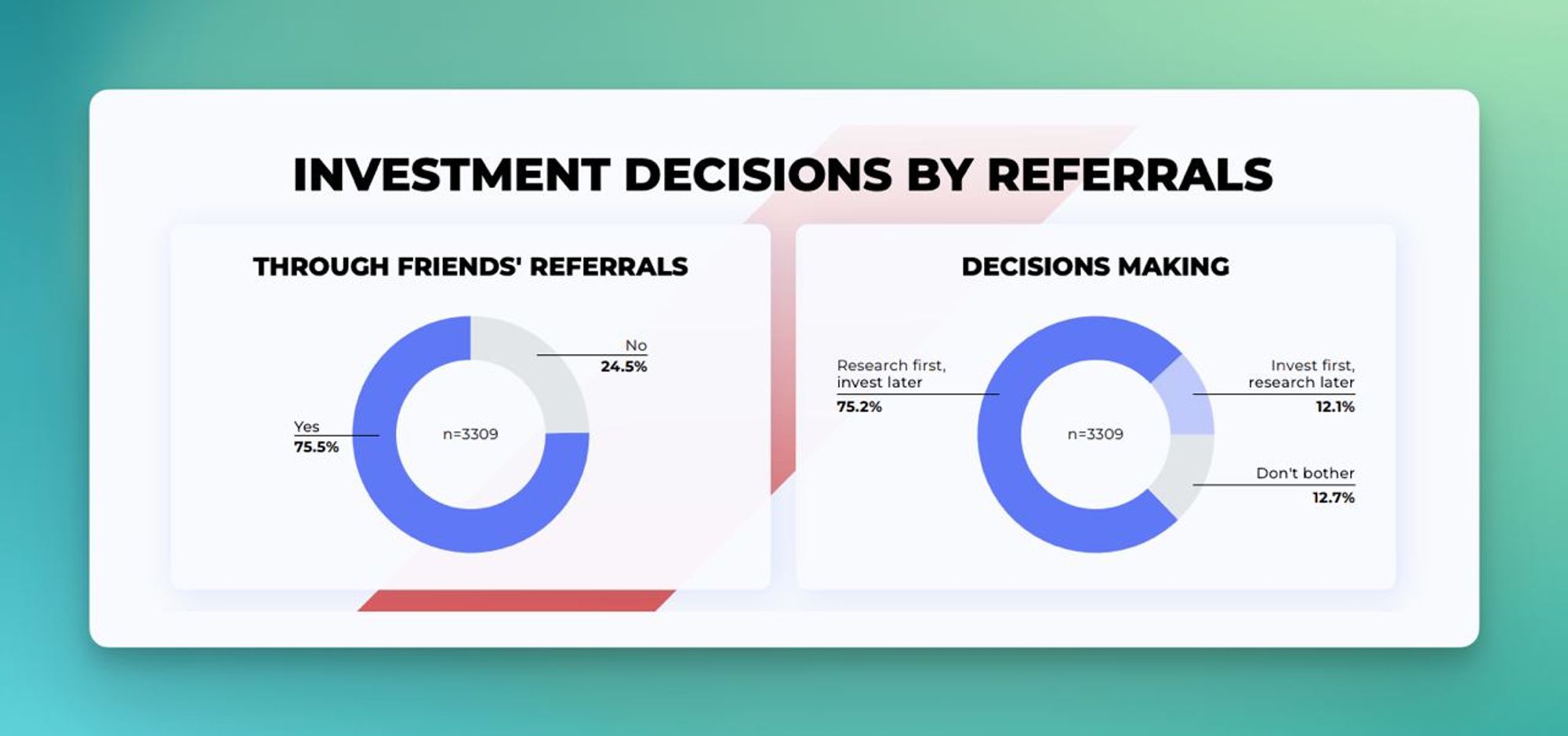

75% of people invested by their friends’ referrals, and there are 12.1% of them invested first, research later.

The number shows that People invest in crypto because they trust their friends or the KOL. It is not always bad, but it’s bad most of the time. So our team wonders, how can we help users. How can we make them make more effective investment decisions?

Lost too much money when starting to invest in crypto

I can not count how many times I saw some people's messages saying they are running out of money, having big debts for investing in crypto and now all is gone. The hype on every uptrend is undeniable, even for me. Some see their life-changing opportunity, and they don’t want to miss it, since many, many case studies of life-changing opportunities on their social network. But the luck is not for everyone. They get life-changing lessons instead of money and become Crypto haters.

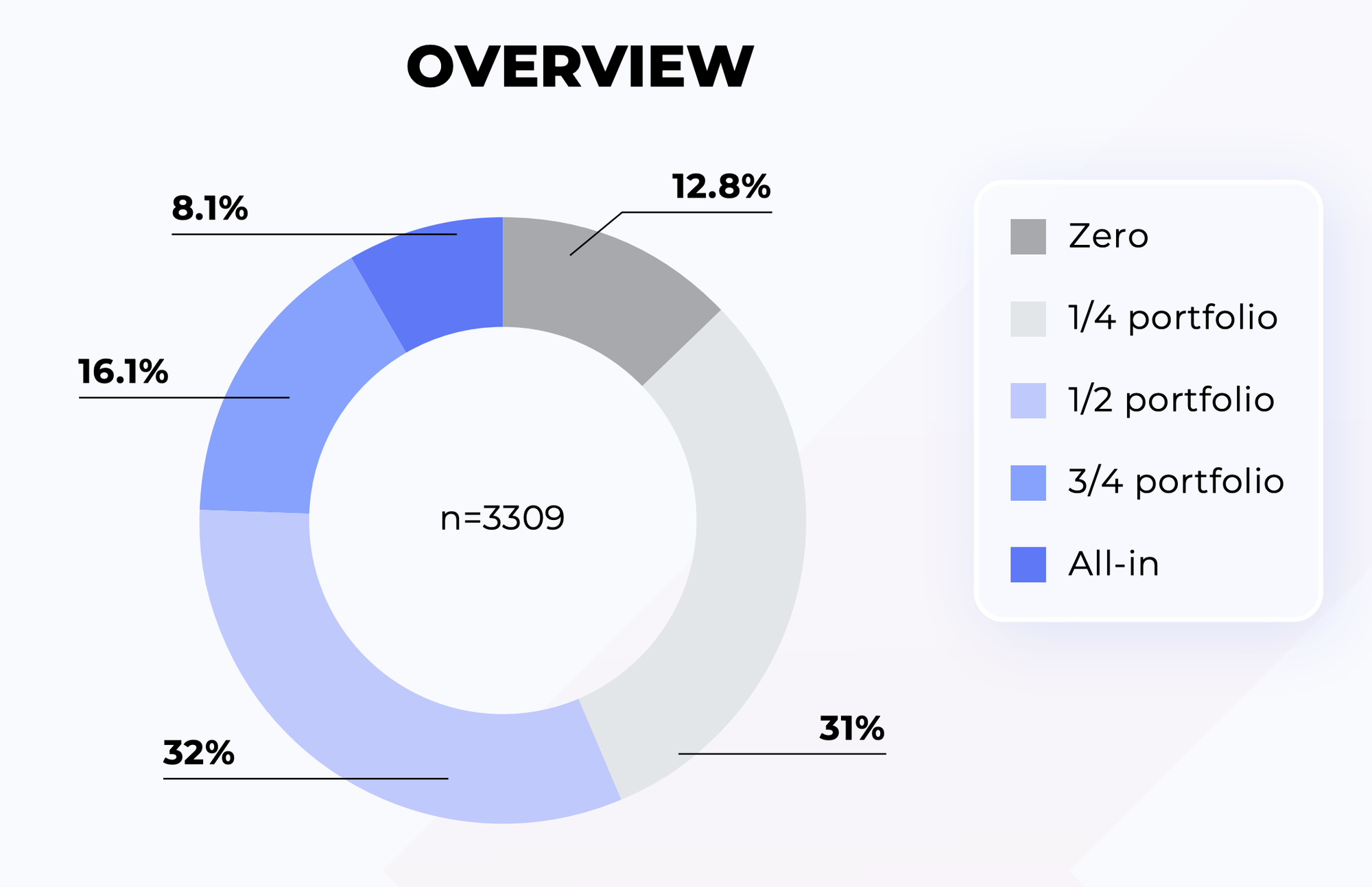

12.8% of them are all in crypto, which can turn into a huge win or a huge loss. I don’t think “Go big or go home” is worth trying in investment. That is exhaustive for your emotions, and it impacts your life badly. I believe that good management of your fund has a big impact on your investment, but how? Should I keep holding a 25% stable coin all the time or 15%? When should I take profit? Those are the biggest questions we need to answer when investing, not just in crypto!

Hard monitor their investment when the market changes rapidly

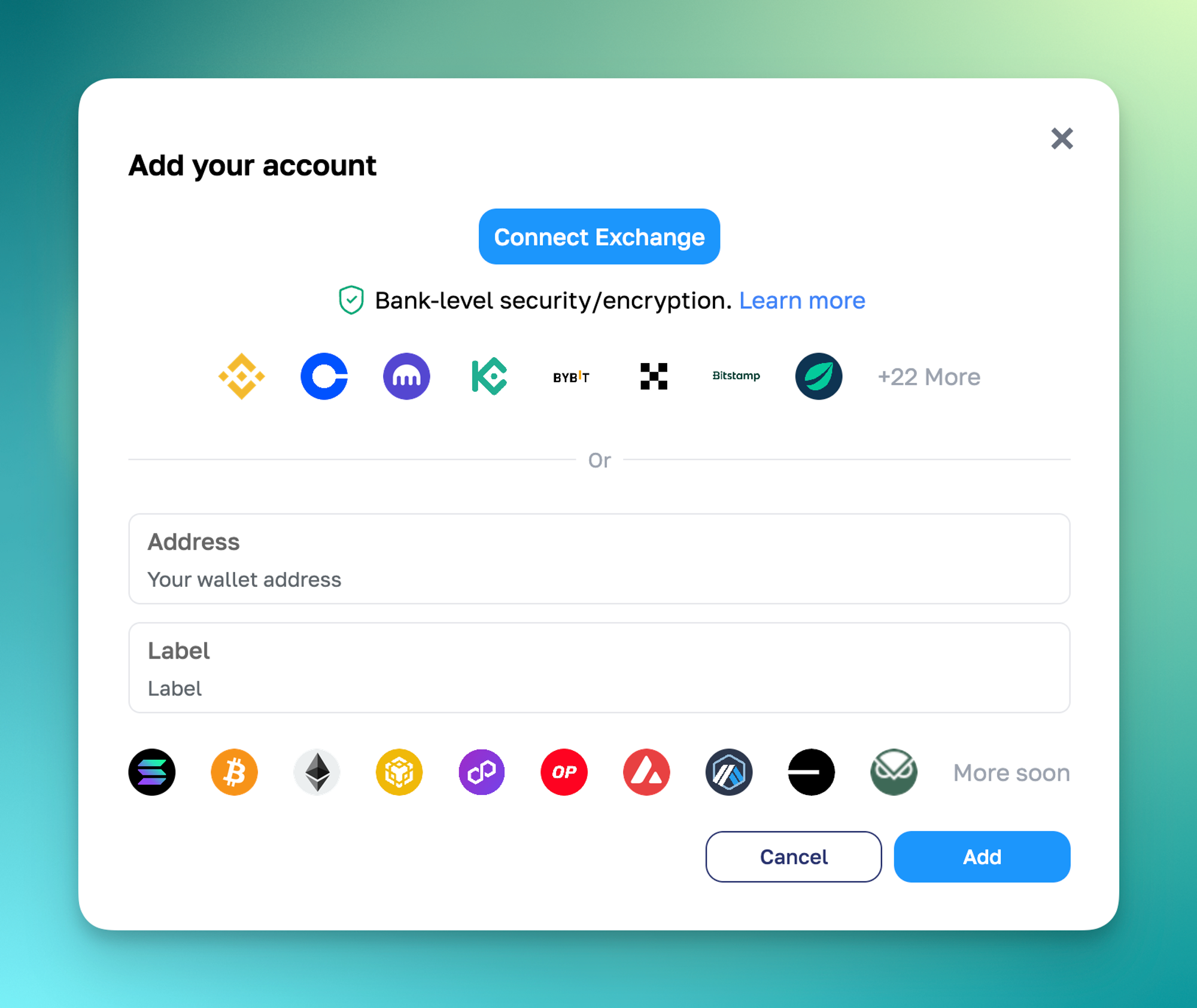

We have so many exchanges living right now, and so many chains that you can start your investment. I can name a few of them like Binance, Bybit, OKX, Ethereum, BNB, Polygon, Solana,…

The problem is, that each exchange or net worth has its times, they compete with each other and have their own advantages, and we have no winner. It’s good for users but comes with the problem that we have to manage our investment in multiple places, in multiple platforms, in different kinds of metrics.

Blockchain is well known for its volatility, you are a billion in the morning and you can turn into a poor guy in the afternoon. So we do need a tool to keep tracking the markets and aggregate your investment on different platforms so you save time, and mind while investing in Web3.

How Nimbus can help?

At Nimbus, we focus on solving those 3 problems by first giving tools that can help users track their investment in multiple places with real-time market data.

“If you can’t measure it, you can’t improve”

By focusing on bringing the latest metrics and the most user-friendly experiences, we aim to make Nimbus a portfolio that can give you insight everywhere, every time you need it, we do not limit ourselves to just the Web, chat, or mobile version. If any channel that can help you monitor your investment, we will be there.

After measuring your portfolio, we want to improve it, right? On Nimbus, we try to bring you investment metrics that are easy to understand, clear what is the next step to improve your investment, understand what is risk behind your investment, how to immediate risk,..

In short, we want Nimbus to be the investment assistant that can show you what going on, what is the next step, and tailor your investment thesis.

Me and Nimbus do not guarantee that it can help you win the market. But when you use Nimbus, if you lose, we help you lose less, if you win, we help you win more.

Nimbus vs. other competitors?

Why do we need another tool for your investment journey? There are so many tools that do the same like Excel, CoinStats, DeBank, Zerion, Nansen

ㅤ | Nimbus | Excel | CoinStats | DeBank | Nansen |

On-chain tracking | ✅ | ⛔ Manual | ✅ | ✅ | ✅ |

DEFI positions | ⚠️ (Soon) | ⛔ Manual | ⚠️ Not fully support | ✅ | ⚠️ Not fully support |

CEX tracking | ✅ | ⛔ Manual | ✅ | ⛔ | ⛔ |

Notification | ✅ | ⛔ | ✅ | ⛔ | ⛔ |

Market data | ⛔ | ⛔ | ⛔ | ⛔ | ✅ |

Risks metrics | ✅ | ⛔ | ⛔ | ⛔ | ⛔ |

Investment metrics (Risks, returns, Sharpe ratio,…) | ✅ | ⛔ | ⛔ | ⛔ | ⛔ |

Optimize earning | ✅ | ⛔ | ⛔ | ⛔ | ⛔ |

Aggregate data multiple accounts | ✅ | ⛔ Manual | ✅ | ✅ | ⛔ |

Basically what makes us different from other solutions is we give you a micro view, and insightful investment metrics just for you, and in turn, help you gain more while reducing risk while investing in this market

The journey has just begun

I was always like the quote

The journey of Nimbus has just begun, our team is dedicated to the problem, and we want to help more people invest in Web3 in the easy and stress-free mode, and make their life better.