Aptos (APT)

What tools does Nimbus offer for effortlessly monitoring Aptos?

Nimbus provides a user-friendly tracking solution equipped with intuitive tools to monitor Aptos effortlessly. These tools are specifically designed for user convenience, allowing individuals to stay seamlessly updated on the latest trends, prices, and information related to Aptos. Users can also explore the world of cryptocurrency effortlessly while simultaneously tracking Aptos prices. The platform also offers insights into profit and loss, providing a comprehensive experience without the complexity typically associated with monitoring cryptocurrencies.

How does Nimbus enable tracking Aptos prices with profit and loss?

Nimbus facilitates the tracking of Aptos prices with profit and loss through seamless integration with your crypto wallet for portfolio monitoring. By connecting with your crypto wallet, Nimbus provides a clear and comprehensive overview of various metrics, including profits, losses, revenue, expenses, return on investment (ROI), and other essential financial indicators. This integration ensures that users can analyze their cryptocurrency portfolio with precision, gaining valuable insights into their financial performance. With Nimbus, users can navigate the cryptocurrency landscape with a perfect blend of simplicity and sophistication, enhancing their ability to make informed investment decisions.

How does Nimbus analyze Aptos, and what insights does it provide?

Certainly! Nimbus possesses a robust analysis tool that is adept at evaluating and interpreting Aptos . The tool employs diverse strategies, including delving into metadata details, tracking marketplace data, and calculating performance metrics such as Return on Investment (ROI). Through these methodologies, Nimbus provides users with valuable insights into the composition and performance of their Aptos. Users can gain a comprehensive understanding of their investment. The analysis tool ensures that users are equipped with the necessary information to navigate the cryptocurrency landscape with confidence and intelligence.

Trending News

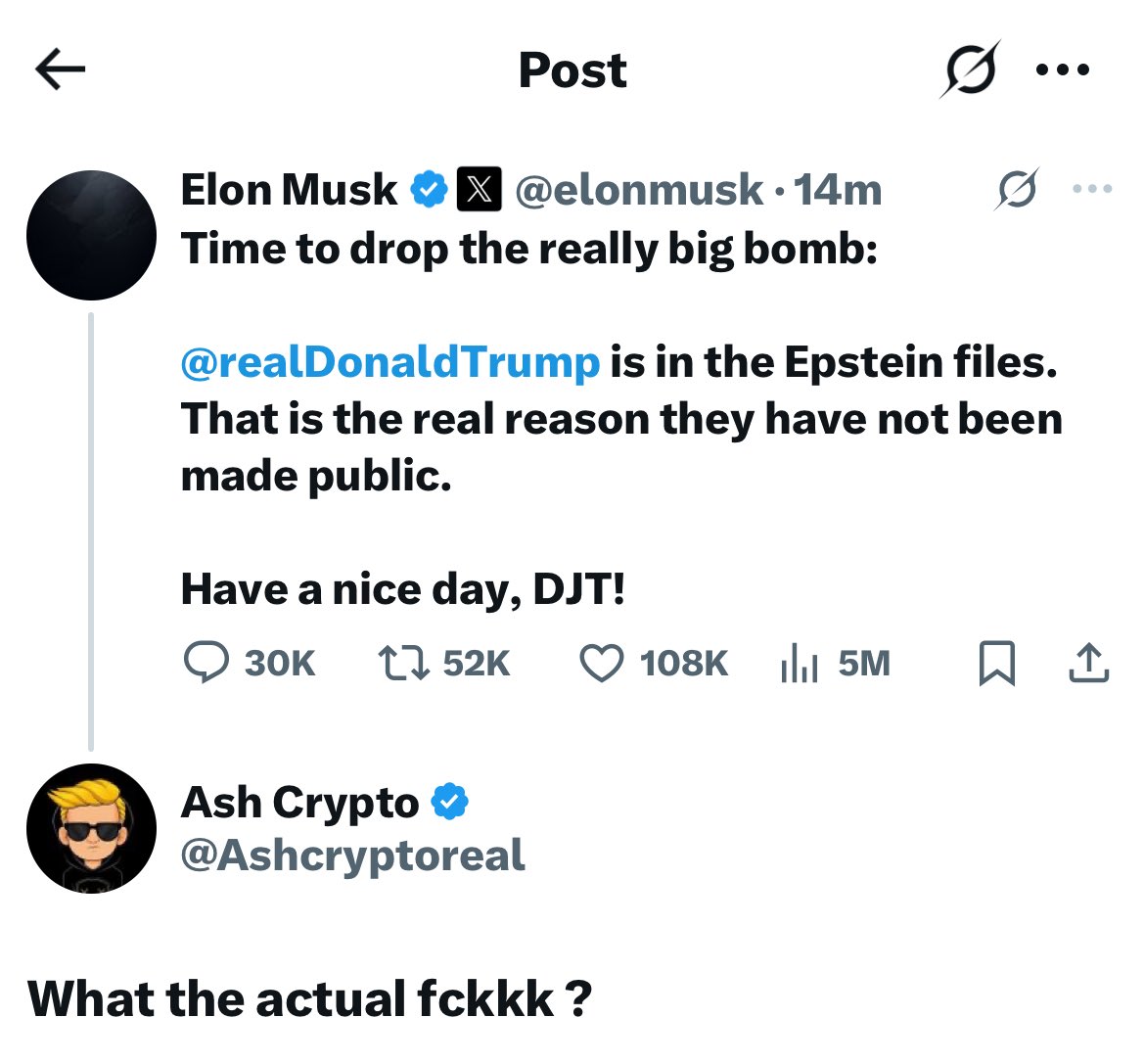

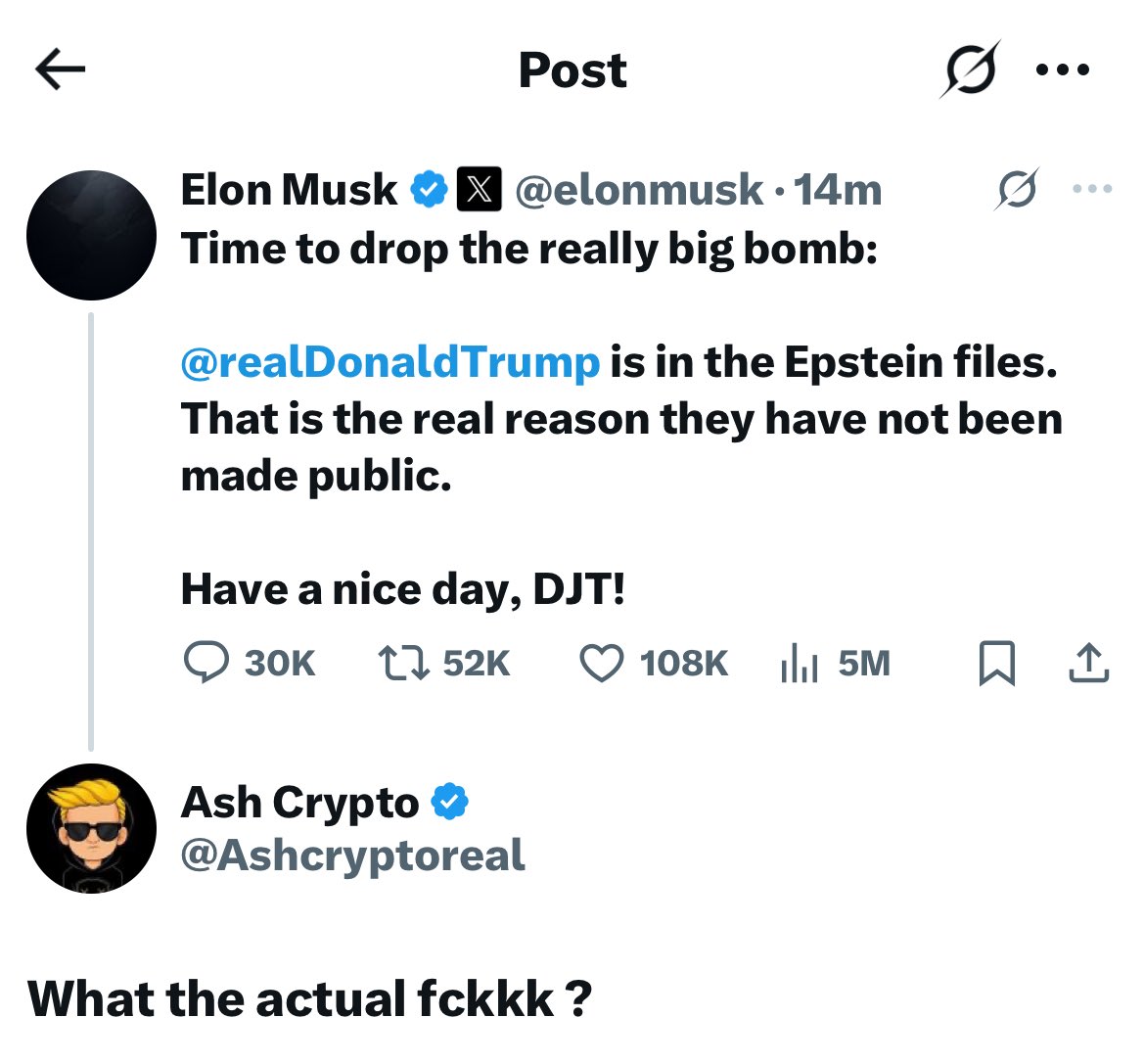

Son Dakika: Kripto Paralar Çakılıyor, Elon Musk’tan Şok Trump İddiaları

BTC 101.596 dolara kadar geriledi. Elon Musk: "Trump Epstein dosyalarında.

Cointurk News TR

Jun 05, 2025

Son Dakika: Kripto Paralar Çakılıyor, Elon Musk’tan Şok Trump İddiaları

BTC 101.596 dolara kadar geriledi. Elon Musk: "Trump Epstein dosyalarında.

Cointurk News TR

Jun 05, 2025

Fact Check: Elon Musk’s Alleged Post on Epstein Files

Detail: https://coincu.com/341828-elon-musk-epstein-files-claims/

CoinCu

Jun 05, 2025

Fact Check: Elon Musk’s Alleged Post on Epstein Files

Detail: https://coincu.com/341828-elon-musk-epstein-files-claims/

CoinCu

Jun 05, 2025

Ohhhh shit…it’s happening 🍿

That Martini Guy Twitter

Jun 05, 2025

Ohhhh shit…it’s happening 🍿

That Martini Guy Twitter

Jun 05, 2025

Ethereum ETF Holdings Spike as BlackRock Snaps Up $560 Million in ETH

Ethereum (ETH) trades within a narrow range, with major institutional investors increasing their exposure. According to on-chain analytics platform Lookonchain, BlackRock has accumulated over 214,000 ETH over the week—worth approximately $560 million. The move coincides with a period of price consolidation for ETH, which has hovered between $2,500 and $2,700 over the last several weeks. […]

Zycrypto

Jun 05, 2025

Ethereum ETF Holdings Spike as BlackRock Snaps Up $560 Million in ETH

Ethereum (ETH) trades within a narrow range, with major institutional investors increasing their exposure. According to on-chain analytics platform Lookonchain, BlackRock has accumulated over 214,000 ETH over the week—worth approximately $560 million. The move coincides with a period of price consolidation for ETH, which has hovered between $2,500 and $2,700 over the last several weeks. […]

Zycrypto

Jun 05, 2025

Tether Invests in Shiga Digital to Power Africa’s On-Chain Finance Future

Highlights: Tether has invested in Shiga Digital to assist with developing blockchain-based services across Africa. Through this initiative, African firms can send and receive money across the globe using USDT. Africa’s crypto growth sees increased focus on stablecoins and blockchain […]

Crypto2Community

Jun 05, 2025

Tether Invests in Shiga Digital to Power Africa’s On-Chain Finance Future

Highlights: Tether has invested in Shiga Digital to assist with developing blockchain-based services across Africa. Through this initiative, African firms can send and receive money across the globe using USDT. Africa’s crypto growth sees increased focus on stablecoins and blockchain […]

Crypto2Community

Jun 05, 2025

APT Market Statistics

Price USD

$11.73Market Cap

$6,249,129,785.26Total Volume USD

$438,397,882.39Total Supply

1,126,655,404.91 APTCirculating Supply

532,633,674.98 APTFully Diluted Market Cap

$13,218,495,523.85Socials

Official links

Join us to Maximize your Returns & Minimize your Risk

Gain access to all exclusive data, insight that can make your investment more joy