- Crypto is well-known for its high volatility caused by Supply/Demand, Speculation, Liquidity, and Technology

- Some ways to deal with volatility

- Diversify your portfolio with help from Nimbus

- DCA because you never know what is a good entry or exit point. We have the tool for you as well

- Identify risk and address it

- Education

Volatility: What It Means for Crypto Investors

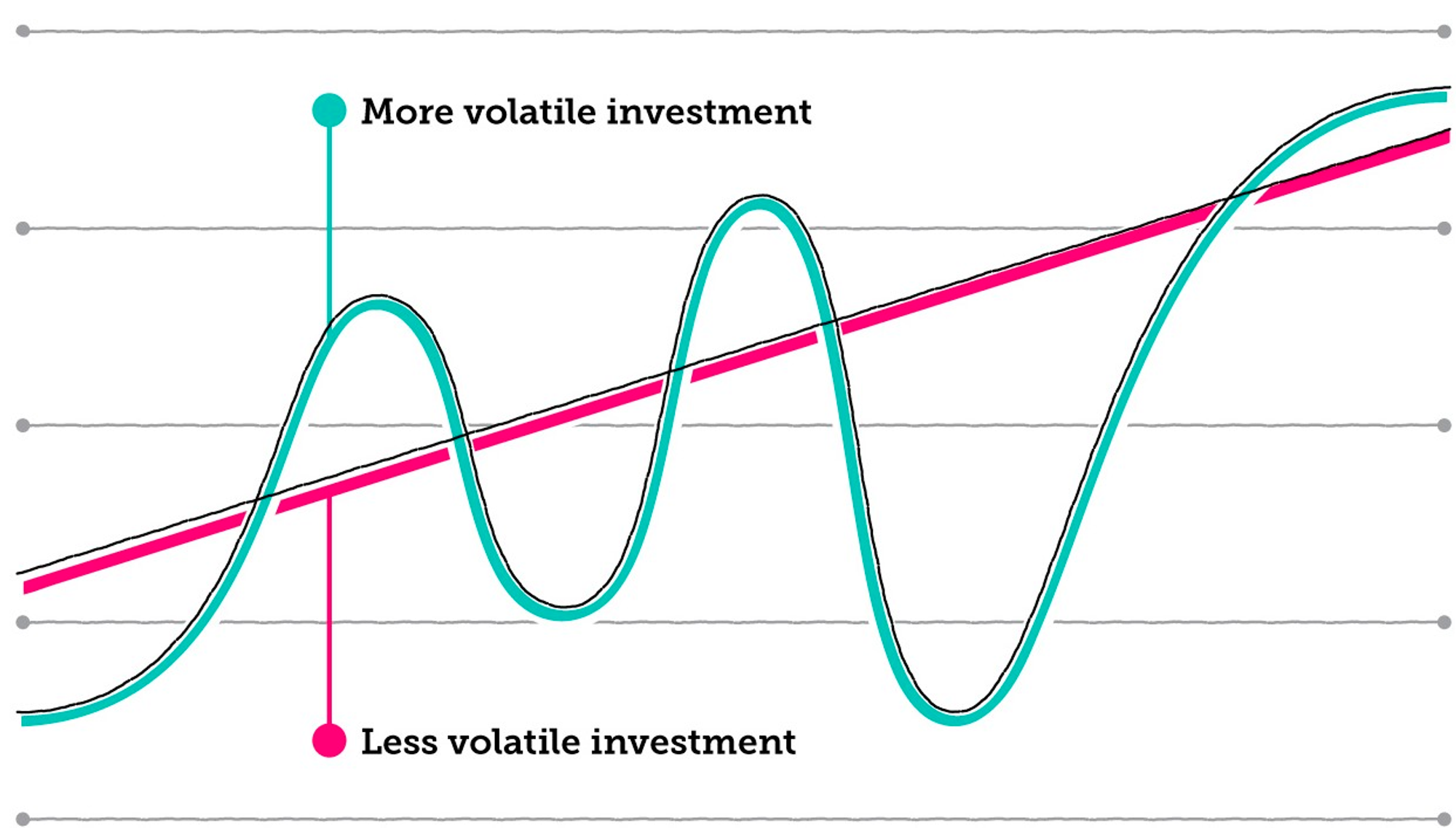

Volatility is a measure of how much the price of an asset changes over time. It is often expressed as a percentage or a standard deviation. The higher the volatility, the more unpredictable and risky the asset is.

Volatility is especially relevant for crypto investors, as cryptocurrencies are known for their frequent and large price swings. For example, Bitcoin, the most popular and valuable cryptocurrency, has experienced several periods of high volatility in its history, such as in 2017, when it reached an all-time high of nearly $20,000 and then dropped to below $4,000 in 2018, or in 2021, when it surged to over $60,000 and then plunged to around $30,000.

Why are cryptocurrencies so volatile?

There are many factors that contribute to the volatility of cryptocurrencies, such as:

- Supply and demand: Cryptocurrencies have a limited supply, which means that their price is determined by the market forces of supply and demand. When there is more demand than supply, the price goes up, and vice versa. Demand can be influenced by various factors, such as media attention, public perception, innovation, regulation, adoption, etc.

- Speculation: Cryptocurrencies are often subject to speculation, which means that investors buy and sell them based on their expectations of future price movements, rather than their intrinsic value. Speculation can create bubbles and crashes, as well as increase volatility.

- Liquidity: Liquidity is the ability to buy and sell an asset quickly and easily without affecting its price. Cryptocurrencies have relatively low liquidity compared to other assets, such as stocks or bonds, which means that even small trades can have a significant impact on the price. Low liquidity also makes cryptocurrencies more susceptible to manipulation and fraud.

- Technology: Cryptocurrencies rely on complex and evolving technology, such as blockchain, cryptography, consensus algorithms, etc. Technology can affect the performance, security, scalability, and usability of cryptocurrencies, as well as introduce new features and innovations. However, technology can also pose challenges and risks, such as bugs, hacks, forks, network congestion, etc., which can affect the price and confidence of cryptocurrencies.

How can crypto investors deal with volatility?

Volatility can be both a blessing and a curse for crypto investors. On one hand, volatility can create opportunities for profit by allowing investors to buy low and sell high. On the other hand, volatility can also create losses by exposing investors to unpredictable and unfavorable price movements.

Therefore, crypto investors need to be aware of the risks and rewards of volatility and adopt appropriate strategies to deal with it. Some of these strategies include

Diversification

Diversification is the practice of spreading one's investments across different assets or sectors to reduce risk and increase returns. By diversifying their portfolio, crypto investors can reduce their exposure to the volatility of a single cryptocurrency or the crypto market as a whole.

At Nimbus, you can go to the Analytics tab, and scroll down into the Volatility section which you can

- Compare your portfolio volatility to Bitcoin and Ethereum

- Deep dive into every single token you have

So you can better understand your portfolio volatility, and re-allocate your investment volatility to match your goal and risk

Dollar-cost averaging

Dollar-cost averaging is the practice of investing a fixed amount of money at regular intervals regardless of the price fluctuations. By doing so, crypto investors can lower their average cost per unit and benefit from the long-term growth of cryptocurrencies.

You can use our tool to plan your DCA, and do a backtest to see how is it better with your plan. Some tests show that our tool out-performance any other DCA tool in the market

Risk management

Risk management is the practice of identifying, assessing, and mitigating the potential losses from investing. Crypto investors can use various tools and techniques to manage their risk, such as setting stop-loss orders, using hedging instruments, allocating only a small portion of their capital to crypto investing, etc.

Education

Education is the key to understanding and navigating the volatile world of cryptocurrencies. Crypto investors should constantly learn about the fundamentals, trends, developments, and challenges of cryptocurrencies and the crypto market. They should also keep themselves updated with reliable sources of information and analysis.

This investment series is the one to help you increase your knowledge and convert it into wealth. With our vision to help users on their path to financial freedom, we hope this series can bring you knowledge, and skills in this market

Volatility is an inherent feature of cryptocurrencies that can bring both opportunities and challenges for crypto investors. By being informed, prepared, and strategic, crypto investors can embrace volatility and make it work for them.